Sending money internationally? Here's what you need to know. From fees to processing times, this guide breaks down the eight most important factors to ensure your money reaches its destination efficiently and securely. With $818 billion in global remittances recorded in 2023, understanding these key points can save you time and money:

- Exchange Rates: Compare live rates and watch for hidden markups.

- Fees: Know flat fees, percentage-based charges, and intermediary costs.

- Processing Times: Delivery speeds vary by method - wires, ACH, or cash pickups.

- Security: Verify recipient details and stay alert to fraud risks.

- Compliance: Be ready with required documents and meet reporting thresholds.

- Transfer Limits: Understand provider caps and how to handle large sums.

- Platform Choice: Pick a secure, user-friendly service with clear pricing.

- Record-Keeping: Keep detailed records for compliance and tracking purposes.

Quick Tip: Use tools like Wise or RemitFinder to compare rates and fees, and always double-check details before finalizing your transfer.

Keep reading for detailed insights to help you navigate international transfers like a pro.

Best International Money Transfer Service 2025💸 [My Honest Recommendation]

1. Exchange Rates and Currency Conversion

The exchange rate is a key factor in determining how much money your recipient actually receives when you send funds internationally. These rates shift daily, influenced by economic trends, political events, inflation, and market demand. Even minor differences in rates can have a noticeable impact. For instance, sending $1,000 at a better rate could mean your recipient gets $980 instead of $950 in their local currency.

"Exchange rates are a major part of the remittance process - and they can work in your favor with the right tools." – Afriex

Higher interest rates tend to strengthen a currency by attracting foreign investment. Additionally, political stability and inflation levels significantly influence currency strength. Keeping an eye on these factors and timing your transfers wisely can help you take advantage of better rates. Monitoring rate trends and comparing real-time offers from providers is key to maximizing the amount your recipient receives.

1.1 Compare Real-Time Rates

To secure the best exchange rate, compare live rates from different banks and money transfer services. These rates often update in real time based on market conditions. Tools like currency converter apps and bank platforms can help you track rates across multiple currencies and even set up alerts for favorable changes. If your transfer isn't urgent, waiting for a better rate can save you a decent amount.

Services like RemitFinder and Cambridge Currencies make it easy to compare rates and fees across providers. However, always double-check the rate right before confirming your transfer, as online rates can lag during volatile market conditions.

1.2 Margin Fees Explained

Some providers may advertise "no fee" transfers but hide costs in their exchange rate markups. This practice can make it tricky to figure out the true cost of your transaction. Typically, providers start with the mid-market rate - the rate you see on financial news - then add a markup to it. For example, if the mid-market rate for USD to EUR is 0.85, you might be offered 0.82, with the 0.03 difference serving as the provider's profit.

Foreign transaction fees can add even more to the cost, often ranging between 1% and 3% of the transfer amount. Some services, like Wise, use the mid-market rate and clearly display fees upfront. Others, such as EQ Bank, avoid hidden markups altogether. To identify these margin fees, compare the provider's rate to the mid-market rate and ask for a detailed breakdown of all charges. Understanding both explicit fees and rate markups will help you choose the most cost-effective option for your international transfer.

2. Transfer Fees and Hidden Costs

When it comes to international money transfers, the costs can go well beyond the exchange rate markup. Transfer fees, often hidden in plain sight, can quickly pile up and eat into the amount your recipient actually receives. For instance, cross-border fees can chip away at 5–7% of a business's revenue. These charges often originate from less obvious sources, making it essential to understand every potential fee before initiating a transfer.

Knowing all the charges upfront can help you avoid unpleasant surprises. While some providers may advertise low fees, they often recover costs through hidden charges. Let’s break down the types of fees you might encounter so you can better prepare.

2.1 Types of Fees

International money transfers generally come with three main types of fees:

- Flat Fees: These are fixed charges, unaffected by the amount you transfer. For example, most major banks charge between $35 and $50 for outgoing international wire transfers and $20 to $35 for domestic transfers. To illustrate, Bank of America charges $45 for international wires sent in U.S. dollars, while Chase Bank's fees range from $40 to $50 for the same service.

- Percentage-Based Fees: These fees are calculated as a percentage of the transfer amount and are often hidden within the currency conversion markup. Typically, this markup is 1–3% above the mid-market exchange rate. For example, transferring $10,000 with a 2% markup would cost you an additional $200 compared to the true market rate.

- Intermediary Bank Charges: These are some of the most unpredictable fees. When your money passes through intermediary banks, each may charge between $15 and $30 for processing the transaction. Depending on how many banks are involved (usually 1–3), these charges can add up to $45–$90, often deducted from the transfer amount, leaving your recipient with less than expected.

| Fee Type | Typical Range | Examples |

|---|---|---|

| Outgoing International Wire | $35–$50 | Bank of America: $45; Chase: $40–$50; TD Bank: $50 |

| Incoming Wire | $0–$16 | Wells Fargo: $0 (foreign currency), $25 (USD) |

| Intermediary Bank | $15–$30 per bank | 1–3 banks |

| Currency Markup | 1–3% above mid-market | $200 markup on a $10,000 transfer at 2% |

Transparency about these fees is critical. Make sure to carefully evaluate each provider’s fee structure before proceeding.

2.2 Check Fee Transparency

Not all providers are equally transparent about their fees. The best services will clearly outline all potential charges before you finalize your transfer, including intermediary fees, so you know exactly how much your recipient will receive.

Traditional banks often rely on older systems that involve multiple intermediaries, leading to higher and less predictable costs. On the other hand, modern fintech platforms use advanced technology and direct banking relationships to offer better rates and clearer fee structures. Some fintech companies charge as little as one-fifth of what traditional banks do.

When evaluating providers, look for those who disclose all charges upfront, including intermediary fees. Some even offer options like "OUR" payment instructions, where you cover all intermediary fees to ensure your recipient gets the full amount.

Be cautious of providers that fail to provide a clear total cost estimate, advertise "free" transfers without explaining how they generate revenue, or refuse to disclose their exchange rate markup. Providers with extensive banking networks often reduce the need for intermediaries, resulting in more predictable costs and greater transparency.

3. Processing Times and Delivery Methods

The speed of money transfers depends on the delivery method you choose. Understanding these options can help you avoid unnecessary delays.

Wire transfers are generally fast. Domestic wires are completed within the same or next business day, while international wires typically take 1–5 business days. Thanks to the Expedited Funds Availability Act (EFAA), U.S. financial institutions are required to credit funds for domestic wires within one business day.

ACH transfers, on the other hand, are slower, taking 1–3 business days to process. This method remains a popular choice, with the ACH network processing an enormous volume of payments in 2023. For those in a hurry, same-day ACH is available for an additional fee.

For near-instant transfers, cash pickups and mobile wallet transfers are often completed within minutes. Similarly, debit card transfers tend to be quicker than traditional bank transfers, which can take several days.

3.1 Average Processing Times

Transfer speeds vary widely across providers based on their systems and delivery methods. Here’s a look at what to expect:

| Provider | Estimated Transfer Time |

|---|---|

| Banks (via SWIFT) | 1–5 working days |

| Wise | Seconds to 2 working days |

| Western Union | Minutes to 5 working days (bank transfers); Minutes to 4 working days (cash pickup) |

| MoneyGram | 1 hour to next working day |

| WorldRemit | Usually within minutes |

| Xoom | Hours for bank transfers; Minutes for cash pickup |

| XE | 1 to 4 working days |

| Remitly | Minutes with Express (extra fee); 3–5 working days for Economy transfers |

Some services stand out for their speed. For example, Wise reports that 64% of its transfers are completed in under 20 seconds, with 95% arriving within a day. Similarly, WorldRemit emphasizes that most of its transfers are completed within minutes.

Geography also matters. Transfers between North America and Europe are often processed quickly. However, transactions involving Africa may take longer due to compliance checks and delays with intermediary banks. In the best-case scenario, a transfer can reach the recipient within a single business day.

These timelines depend on several factors, which are discussed below.

3.2 What Affects Transfer Speed

A variety of operational factors can influence how quickly your transfer is processed.

Cutoff times and banking schedules are among the most important considerations. U.S. banks have specific deadlines for processing international transfers, typically ranging between 4:00 PM and 5:15 PM Eastern Time. Missing these deadlines means your transfer won’t be processed until the next business day. Wire transfers are only handled during regular banking hours, Monday through Friday.

| Bank | International Wire Cutoff Times |

|---|---|

| Bank of America | 5:00 PM Eastern Time |

| Chase Bank | 4:00 PM Eastern Time |

| Citibank US | 5:15 PM Eastern Time |

| Goldman Sachs | 4:00 PM Eastern Time |

| US Bank | 4:00 PM Eastern Time |

| Wells Fargo | 5:00 PM Eastern Time |

Public holidays in the U.S. or the recipient’s country can also delay transfers. Banks do not process transactions on holidays, and any payments initiated over a weekend won’t be processed until the next business day.

To avoid delays:

- Initiate transfers early in the business day to meet the first processing batch.

- Double-check account details to prevent errors and returned payments.

- For international transfers, allow at least 3–5 business days.

- Plan ahead and ensure your transfer is scheduled well before the bank’s cutoff time.

"You'll likely pay lower costs and your recipient will get the money faster using one of the following licensed money transfer companies instead of your bank." - NerdWallet

Transfers initiated outside of banking hours will face delays. Being mindful of holidays in both the sending and receiving countries can also help you better plan your transfers.

4. Security Measures and Fraud Protection

When sending money internationally, keeping your transfer secure should be a top priority. While strong regulations are in place to protect your transactions, staying alert to potential scams is equally important. Below, we’ll explore key U.S. regulations and practical tips to help you safeguard your transfers.

4.1 US Regulations and Protections

In the U.S., several regulations work together to ensure the safety of international money transfers. At the forefront are the Bank Secrecy Act (BSA) and the USA PATRIOT Act, which provide the framework for anti-money laundering (AML) measures. The Financial Crimes Enforcement Network (FinCEN) oversees these efforts, requiring financial institutions to identify, prevent, and report suspicious activities that could indicate money laundering or terrorist financing.

The USA PATRIOT Act further strengthens these safeguards by mandating AML programs that verify customer identities, monitor transactions, and block dealings with sanctioned entities. Central to these efforts are Know Your Customer (KYC) protocols and Customer Due Diligence (CDD) measures, which help financial institutions assess the source of funds and identify unusual transaction patterns.

Additionally, regulations like 31 CFR 1020.410(a) and the "Travel Rule" (31 CFR 1010.410(f)) enforce detailed recordkeeping and verification for larger transfers. If any suspicious activity is detected, financial institutions are required to file Suspicious Activity Reports (SARs) with FinCEN.

Just as understanding fees and processing times is essential, ensuring your transfer adheres to these protections is equally important.

4.2 How to Avoid Fraud

Even with stringent regulations, fraudsters continue to develop clever tactics. To protect yourself, always verify recipient details through multiple channels. Never rely solely on email for new wire transfer instructions; instead, confirm details by calling the recipient using a trusted phone number. If you're working with a business, use their official, publicly listed contact information rather than any number provided in unexpected communications.

Be wary of urgent transfer requests. Scammers often create a false sense of urgency to pressure you into acting quickly. If you receive such a request, take a step back and independently verify the instructions before proceeding.

Always use secure networks for transfer-related activities. Public Wi-Fi or unsecured connections can be vulnerable to hacking. Phishing remains a significant threat, with fraudsters using emails, phone calls (vishing), text messages (smishing), or even highly targeted "whaling" campaigns aimed at executives.

Here are some tips to protect yourself from phishing attempts:

- Enable spam filters on your email accounts.

- Avoid sharing personal or financial information unless the connection is secure.

- Ignore and delete messages that request sensitive details.

- Verify any suspicious messages by contacting the sender directly using a known number.

- Check for a lock icon or "https:" in the web address to ensure a website is secure.

Make it a habit to review your bank and credit card statements regularly for unauthorized transactions. Catching fraudulent activity early can minimize potential losses.

Remember, wire transfers are generally irreversible - once the money is sent, it belongs to the recipient. If you ever feel unsure or uneasy about a transfer request, pause and consult your bank or a trusted financial advisor before moving forward.

sbb-itb-165eed9

5. Compliance and Documentation Requirements

When it comes to international transfers, strict adherence to compliance and documentation rules is essential. These measures are designed to prevent money laundering and terrorist financing. Just like fees and processing times, meeting these standards is a critical component of completing a transfer successfully. Financial institutions are required to verify your identity, the origin of your funds, and the purpose behind your transfer to meet both international and domestic regulations. Knowing which documents are needed and understanding reporting thresholds can help streamline the process.

5.1 Required Documents

To carry out an international transfer, you’ll need to provide certain documents as part of the Know Your Customer (KYC) protocols. For larger transactions, expect additional scrutiny.

- Proof of Identity: A government-issued photo ID, such as a passport or driver’s license.

- Proof of Address: A recent utility bill, bank statement, or lease (dated within the last 3–6 months) showing your name and address.

- Proof of Income or Funds: Bank statements, pay stubs, tax returns, or other documents showing you have sufficient funds.

- Recipient Details: The recipient’s full name, bank information (IBAN, SWIFT/BIC), address, and contact details.

- Transfer Purpose Documentation: Documents explaining the reason for the transfer, such as an invoice, a sale agreement, or an explanatory letter.

Keeping these documents well-organized and readily available is a smart move. Financial institutions may ask for additional paperwork, especially for large transfers or transactions involving certain countries.

5.2 Reporting and Record Requirements

In the U.S., specific reporting thresholds automatically trigger government oversight for international transfers. For instance, any transaction exceeding $10,000 must be reported to the IRS under the Bank Secrecy Act. Financial institutions handle these reports automatically, and attempting to bypass the threshold by breaking up transfers - a practice called "structuring" - is illegal and carries severe penalties.

If you hold foreign financial accounts, you’re required by the Financial Crimes Enforcement Network (FinCEN) to file a Foreign Bank Account Report (FBAR) if the combined balance of your accounts reaches $10,000 or more at any point during the year. Additionally, individuals with foreign financial assets valued at $50,000 or more generally need to report these assets on their annual tax return using Form 8938.

Non-compliance can result in a $10,000 fine, with additional penalties applied every 30 days. Persistent violations could lead to civil or criminal penalties, including restitution or even imprisonment.

To stay on the safe side, keep detailed records such as receipts, documentation of transfer purposes, and correspondence. For more complex scenarios, like handling large transfers, managing multiple foreign accounts, or conducting business transactions, it’s wise to consult a tax professional familiar with international regulations. This ensures you meet all requirements and avoid unnecessary penalties, giving you peace of mind during the transfer process.

6. Transfer Limits and Regulatory Restrictions

In the U.S., there are no federal limits on international money transfers. Instead, the restrictions and caps depend on the provider, influenced by factors like account type, verification status, and the destination country. Knowing these limits beforehand can save you time and help avoid delays, especially when transferring larger amounts. Let’s break down how provider limits work and what you need to know for handling significant transfers.

6.1 Provider Transfer Limits

Transfer limits vary widely between traditional banks and money transfer services. While banks tend to have stricter limits, especially for online transfers, money transfer services often provide more flexibility for verified users.

Banks typically impose conservative online limits for security reasons, though higher limits may be available for in-branch transactions or premium account holders. For instance:

- Bank of America: Online transfers max out at $1,000 for personal accounts and $5,000 for business accounts.

- Charles Schwab: Allows up to $100,000 per day.

- HSBC: Permits up to $200,000 daily for online payments.

- Citibank: Standard accounts cap transfers at $50,000 per transaction, but premium accounts (like Citigold Private Client) can go up to $500,000.

Money transfer services often offer higher limits, especially for verified users. For example:

- Wise: Allows transfers up to $1,000,000 per transaction.

- Western Union: Unverified accounts are capped at $3,000, but verified users can send up to $50,000.

- PayPal: Verified accounts can transfer up to $60,000, though some currencies have a $10,000 cap.

Verification plays a big role in determining your transfer limits. Most providers require identity verification, proof of address, and sometimes income documentation to unlock higher caps. Additionally, the destination country’s regulations may impose limits. For instance, while Revolut has no general cap for U.S.-based users, transfers to Japan are limited to 1 million JPY.

6.2 Large Transfer Requirements

If you're planning to send larger sums, be prepared for additional steps beyond standard limits. Here’s what you need to know:

Reach out to your provider in advance. Many banks and services can temporarily increase transfer limits or offer alternative ways to process higher amounts. For instance, Wells Fargo allows customers to adjust online limits by contacting customer service, and Chase Bank provides higher caps for Chase Private Client and Chase Sapphire account holders.

Prepare extra documentation. For transfers exceeding standard thresholds, providers may ask for more than the usual Know Your Customer (KYC) details. This could include proof of funds, a clear explanation for the transfer, and verification of the recipient. Wise recommends having these documents ready to avoid delays:

"It's a good idea to have your documents to hand before you start. This will help to speed up the process if we do ask to see them."

Split transfers when necessary. Breaking up a large transfer into smaller amounts can help you stay within provider limits. However, keep in mind that the IRS requires reporting for transactions exceeding $10,000, including multiple payments that cumulatively surpass this amount.

Notify your bank ahead of time. Letting your bank know about an upcoming large transfer can prevent potential security holds and ensure smoother processing.

If you frequently handle large transfers, consider using services tailored for high-value transactions. These providers often offer better exchange rates, dedicated customer support, and streamlined processes designed for larger sums. Whether for personal or business purposes, keeping clear records of the transfer’s purpose and your relationship with the recipient can also help avoid complications.

7. Platform and Tool Selection

Once you've weighed fees, processing times, and security, the next step is choosing the right platform for international transfers. With Statista predicting a global user base of over 3.5 billion by 2024, the importance of platform security cannot be overstated - especially when 77% of money transfer apps have documented security vulnerabilities. Picking a reliable platform is crucial.

Here’s what to consider when evaluating transfer platforms.

7.1 Key Platform Features

When selecting a transfer platform, focus on features that directly impact your security and ease of use. For starters, ensure the platform supports multiple currencies to avoid unnecessary conversion fees or delays.

Security should be a top priority. Look for platforms that use strong encryption, tokenization, and multi-factor authentication (MFA). These measures significantly reduce risks. Additionally, only use platforms that are regulated by recognized financial authorities - steer clear of informal or unlicensed services.

A user-friendly interface, real-time transaction tracking, and responsive customer support across time zones are also essential. These features simplify the process and provide peace of mind.

Finally, check if the platform covers the regions and currencies you need. Ask for a detailed list of supported countries and currencies, and confirm whether the platform offers local routing options beyond SWIFT. This flexibility ensures the platform can grow with your needs.

7.2 Using Cross Border Payments Companies

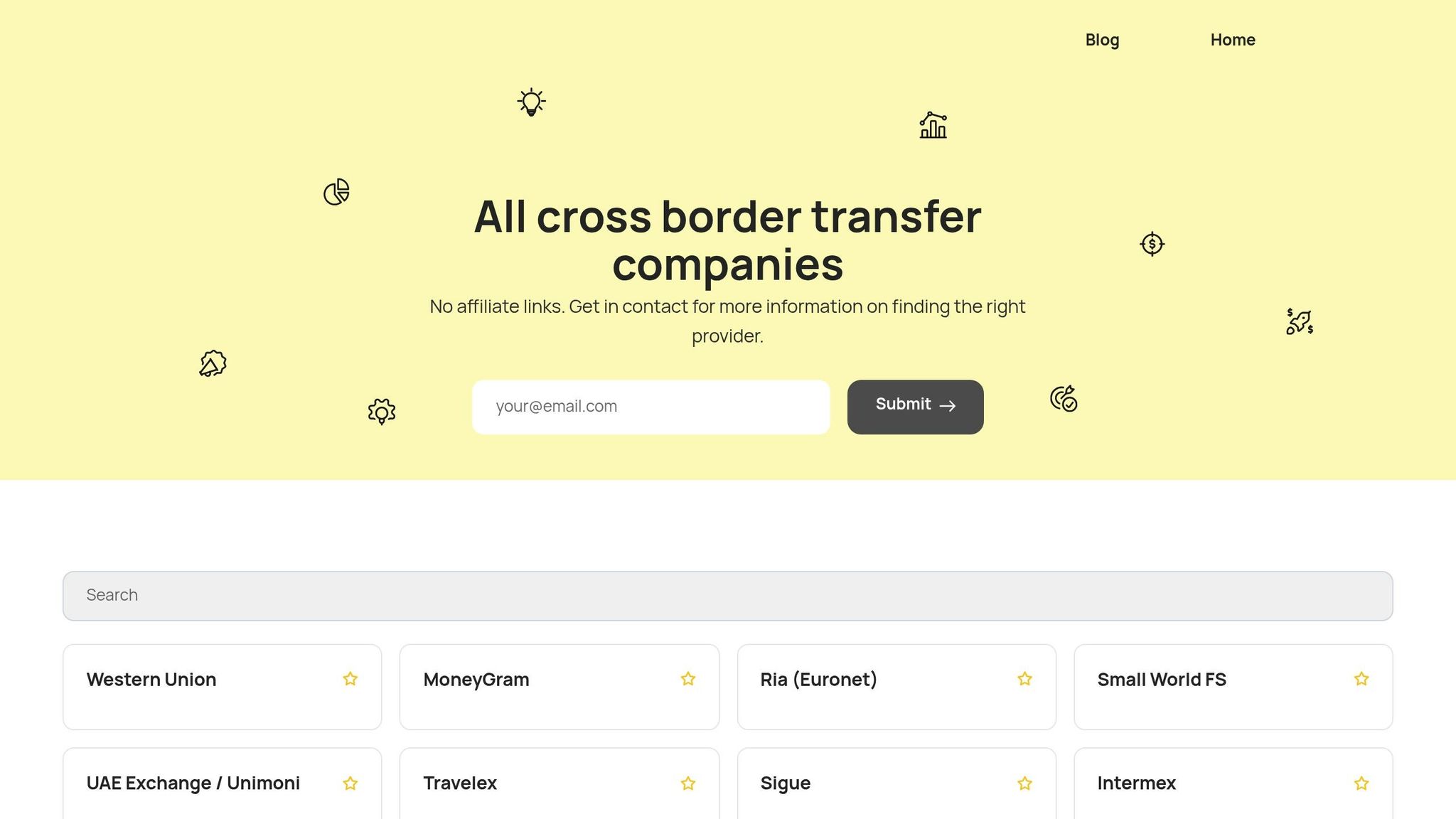

For a more streamlined approach, consider using a dedicated directory like Cross Border Payments Companies. This resource compiles detailed comparisons of over 20 US outbound transfer platforms, ranging from major players to emerging fintech startups. It’s especially useful as global cross-border payment flows are projected to hit $156 trillion by 2022, making reliable navigation of this complex landscape essential for businesses.

The directory doesn’t just list features - it provides in-depth provider profiles, including pros, cons, pricing models, and standout features for platforms like Wise, PayPal, Airwallex, and newer entrants such as Nilos.io. This side-by-side format makes it easier to identify platforms that align with your specific needs and budget.

What sets this directory apart is its focus on practical considerations. It highlights real-world factors like setup difficulties, risks of account freezes, and differences in customer service quality. Whether you’re managing simple remittances or complex business payments, the directory offers insights tailored to your requirements.

For businesses exploring API integrations or technical features, the directory also evaluates developer tools and the complexity of integrations. This is increasingly relevant as nontraditional providers captured up to 65% of international P2P transfer value in 2024. Understanding both established and emerging options is now more important than ever.

Use the directory as a starting point for your research, but remember to verify pricing and features directly with providers. The international transfer landscape changes quickly, and staying informed is key to making the best choice.

8. Record-Keeping and Transaction Tracking

Keeping accurate records and actively tracking your transactions are essential for staying compliant with U.S. tax laws and maintaining financial control when dealing with international transfers. Proper documentation not only helps you adhere to legal requirements but also protects you during potential audits. For instance, the IRS can assess taxes on unreported foreign income or assets exceeding $5,000 for up to six years, making meticulous record-keeping a must for anyone involved in international transfers.

8.1 How to Keep Records

When it comes to record retention, specific timeframes apply. For FBAR (Foreign Bank Account Report) filings, you should keep records for five years from April 15th of the year following the reported calendar year. For general tax purposes, the IRS advises holding onto tax returns and supporting documents for at least three years after filing.

However, these timeframes can extend depending on your situation. For example, if you fail to report income that exceeds 25% of your gross income, the IRS has six years to assess additional taxes. Similarly, unreported foreign financial assets valued at $5,000 or more also fall under a six-year assessment period.

Key documents to retain include transaction confirmations, fee receipts, exchange rate records, bank statements, and compliance forms like CTRs (Currency Transaction Reports) and SARs (Suspicious Activity Reports). Financial institutions are required to maintain specific information for transfers of $3,000 or more, and these records must generally be kept for five years under the Bank Secrecy Act.

"Record retention is critical for all taxpayers, but those with foreign assets are more vulnerable and should take extra care to avoid future headaches." - Virginia La Torre Jeker, J.D.

To keep your records organized, consider printing and saving both digital and hard copies of banking statements annually. Group these records by tax year and ensure you have secure backups. Using encrypted cloud storage for digital files is a smart option, but always consult a tax attorney or accountant before discarding any documents.

| Record Type | Retention Period |

|---|---|

| FBAR Records | 5 years from April 15th of the year following the calendar year reported |

| Tax Returns and Supporting Documentation | Generally 3 years after filing |

| Records related to assets (stocks, bonds, property) | Until the statute of limitations expires for the year you sell or dispose of them |

| Currency Transaction Reports (CTR) | 5 years from the date of filing |

| Suspicious Activity Reports (SAR) | 5 years from the date of filing |

By maintaining well-organized records, you'll be better prepared to manage your transactions and comply with legal requirements.

8.2 Track Your Transfers

Modern transfer platforms have made tracking payments easier and more transparent than ever. Many platforms now offer real-time updates, providing detailed insights into payment routes, processing times, and fees charged at each stage of the transfer process. Automated alerts are another helpful feature, notifying you of important dates like provisional credit deadlines or dispute expiration dates.

Some platforms even include integrated dispute tracking systems, allowing users to initiate and monitor disputes directly through digital interfaces. Advanced tools can also stop payments mid-transfer, helping to mitigate risks tied to fraud or errors.

Reconciliation is another critical aspect of transaction tracking. Platforms that generate consolidated reports across different banks simplify this process. Regular reconciliation ensures financial accuracy and helps reduce fraud risks. Businesses with weak reconciliation practices can see up to a 15% increase in Days Sales Outstanding, highlighting the importance of staying on top of these reviews. In 2022, financial statement fraud accounted for 9% of all reported fraud cases, further emphasizing the need for diligent tracking and reconciliation.

At a minimum, aim to reconcile monthly. For businesses handling a high volume of transactions, more frequent reviews may be necessary. Use filtering tools to quickly identify overdue or unreconciled payments, and address any discrepancies promptly to avoid bigger issues down the line. Together, disciplined record-keeping and advanced tracking tools create a reliable system for safeguarding your finances and ensuring compliance with regulations.

Conclusion

Successfully managing international money transfers means paying close attention to a range of factors. From understanding exchange rates and spotting hidden fees to ensuring robust security measures and proper compliance documentation, every detail matters. These steps are key to protecting your finances and staying on the right side of regulations.

With global B2B cross-border payments projected to hit $165 trillion in 2024 and small business cross-border payments expected to grow by 54% to $21.2 trillion by 2032, any misstep can lead to significant losses. Unfavorable exchange rates, surprise fees, or compliance missteps that lead to penalties can quickly add up. To avoid these pitfalls, it’s essential to compare real-time exchange rates, dig into fee structures for transparency, confirm security certifications, and keep detailed records. Processing times can also vary depending on your chosen method, the destination, and compliance requirements.

While fintech innovations are speeding up transfers and boosting security, these core considerations remain vital. Regulatory scrutiny is only increasing, as one expert highlights:

"There is a lot of friction with cross border payments. We’re trying to balance between efficiency and something which is seamless, but also the safeguarding of funds and compliance and making sure there is no money laundering".

For those looking to fine-tune their international transfer approach, Cross Border Payments Companies offers tools to compare providers. Their platform delivers insights into payment solutions, helping users find services with competitive exchange rates, clear fee structures, faster processing, and compliance expertise tailored to their needs.

Whether you’re handling personal remittances or business transactions, these strategies help you make smarter, safer choices. By evaluating these key factors, you can save money, reduce risks, and ensure compliance with U.S. regulations. A little research and planning go a long way toward achieving efficient, secure, and cost-effective international transfers.

FAQs

How can I make sure I’m getting the best exchange rate for an international money transfer?

To secure the best exchange rate, begin by checking rates from multiple providers. Choose platforms that clearly disclose their fees and provide competitive rates. Watch out for hidden charges, as they can reduce the amount your recipient gets. Timing is another factor - exchange rates can change frequently, so sending money when rates are in your favor can help you save. If you're making a large transfer, it might be worth consulting a specialist who can help you lock in a favorable rate.

What hidden fees should I watch out for in international money transfers, and how can I avoid them?

Hidden fees in international money transfers can sneak up on you, often coming in the form of currency conversion charges, transfer fees, and intermediary bank costs. These extra expenses can quickly chip away at the amount your recipient actually receives.

To keep these costs in check, opt for services that offer clear pricing with no unexpected charges. Paying in the recipient's local currency can also help you dodge unnecessary conversion fees. For larger or frequent transfers, it’s worth exploring options to negotiate lower fees or choosing providers that offer real-time exchange rates and minimal or no transfer fees. The provider you select plays a huge role in cutting down these hidden expenses.

How can I protect myself from fraud when transferring money internationally?

To protect yourself from fraud when making international money transfers, start by confirming the recipient’s identity and carefully reviewing their details to ensure everything is correct. Never share personal or financial information with unknown or unverified parties.

Be especially wary of unexpected offers or requests - if something feels too good to be true, it probably is. Stick to using reliable, secure platforms for your transactions, and make sure the service provider employs strong security measures like encryption and fraud detection tools.

Keep a close eye on your transactions, and if you notice anything unusual, report it immediately to your service provider or financial institution. Staying alert is your best defense against fraud and safeguarding your personal and financial information.