When choosing between Western Union and MoneyGram for international money transfers, the costs depend heavily on how you send and where the money is going. Here's a quick breakdown:

- MoneyGram: Lower fees for debit card-funded transfers, especially for international transactions. For example, sending $500 to Mexico costs just $1.99 with a debit card. However, credit card fees are much higher, reaching $20.49 for the same transfer.

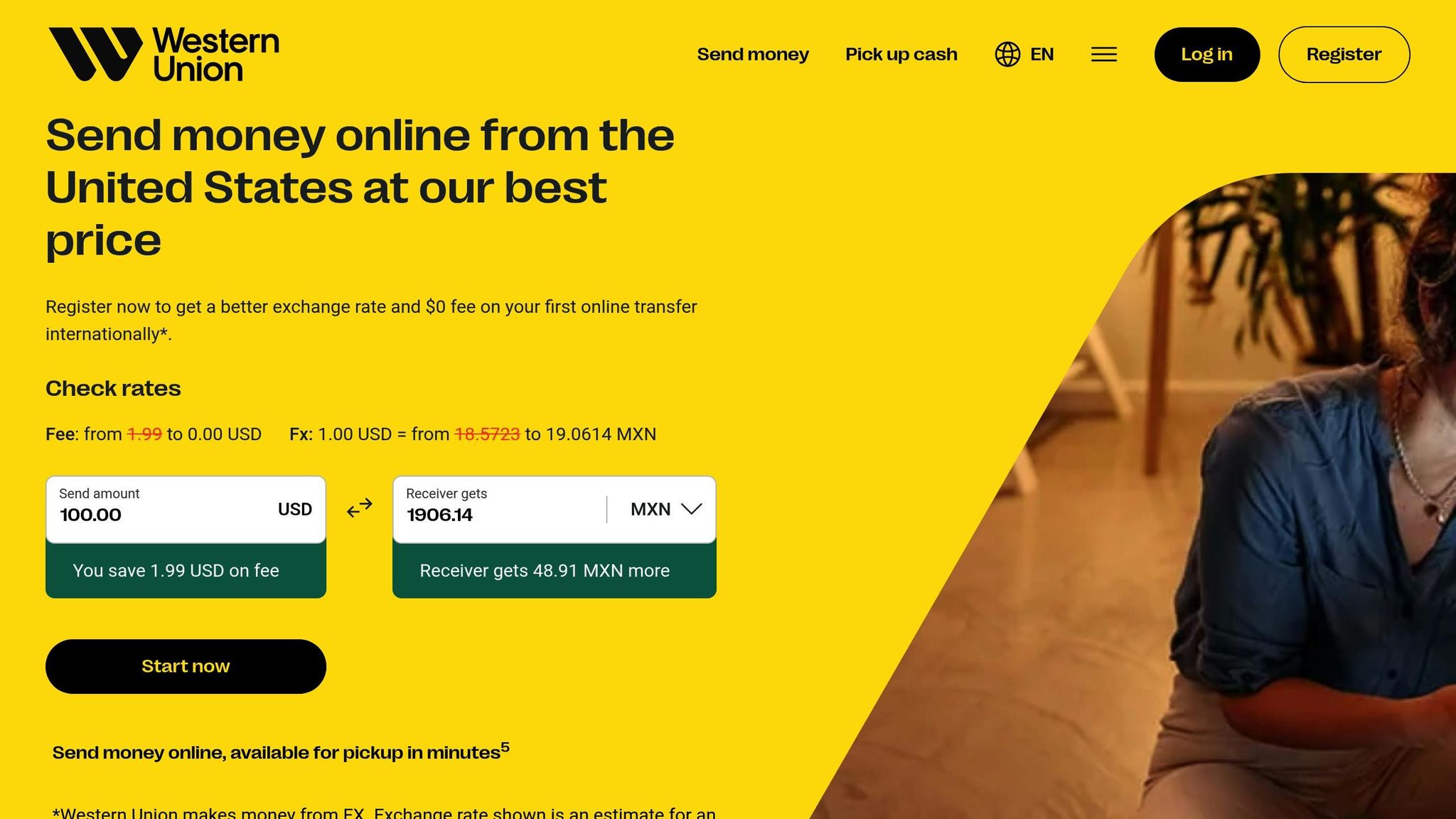

- Western Union: Better for credit card payments and larger transactions. For instance, sending $500 to Mexico costs $11.99 with a credit card. They also allow verified users to send up to $50,000, compared to MoneyGram’s $10,000 limit.

Key takeaway: MoneyGram is cheaper for smaller, debit card-funded transfers, while Western Union works better for credit card payments and larger amounts. But don’t forget - exchange rate markups can also significantly impact the final amount your recipient gets.

Quick Comparison

| Transfer Details | Western Union Fee | MoneyGram Fee |

|---|---|---|

| $500 to Mexico (debit card, cash pickup) | $4.99 | $1.99 |

| $500 to Mexico (credit card, cash pickup) | $11.99 | $20.49 |

| $500 to Mexico (cash at agent, cash pickup) | $8 | $10 |

| $500 to Ireland (debit card, cash pickup) | $5–$7 | $1.99 |

For the best value, always factor in fees + exchange rate margins before making a decision.

NEW! Western Union vs MoneyGram Fees (2025) 💸 | Which Money Transfer Service Saves You More?

How Western Union and MoneyGram Charge Fees

Understanding how Western Union and MoneyGram set their fees can help you decide which provider suits your needs. Both companies use a pricing structure influenced by several factors, including your payment method, how the recipient receives the funds, the destination country, and the transfer speed. On top of these fees, both companies add a margin to the exchange rate, which we'll discuss in the next section.

Western Union Fees Explained

Western Union's fees vary based on how you choose to fund the transfer and how the recipient will receive the money. Rates differ for online transfers, transactions via the mobile app, phone orders, and in-person visits to agent locations.

The payment method you use plays a big role in determining the cost. Credit card transactions tend to be the priciest compared to other options like debit cards, bank accounts, or cash. For example, as of October 2024, sending $200 domestically with cash funding and cash payout costs $13.50. However, if you fund the same transfer from an online bank account, there’s no fee. Using a credit card for that transfer adds a $5 charge.

For international transfers, fees vary even more. Sending $500 from the U.S. to Mexico for cash pickup in pesos costs $4.99 when funded with a debit card, Google Pay, or an online bank account. If you pay with cash at an agent location, the fee rises to $8, and using a credit card bumps it up to $11.99.

Destination countries also influence fees. For instance, sending $500 to Ireland for cash pickup in euros costs $5–$7 for online bank transfers, Google Pay, or debit cards, while credit card payments cost $12.50, and cash payments at an agent location cost $8.

MoneyGram Fees Explained

MoneyGram’s fee structure is similar but often shows greater variation depending on the payment method. The company accepts Visa and MasterCard for both credit and debit card transactions online.

Credit card transactions are particularly costly with MoneyGram. For example, as of October 2024, a $200 domestic transfer funded online with a debit card costs just $2.99. However, credit card fees for the same transaction can be significantly higher.

When it comes to international transfers, MoneyGram’s debit card rates are especially competitive. Sending $500 to Mexico funded with a debit card online costs only $1.99. In contrast, using a credit card for the same transfer increases the fee to $20.49. Paying with cash at an agent location falls in between, at $10.

Similarly, sending $500 to Ireland costs $1.99 with a debit card online, $8 with cash at an agent location, and $20.49 with a credit card. Additionally, credit card transactions may incur extra charges, such as cash advance fees and interest, which can further increase your total cost.

Side-by-Side Fee Comparison

Here’s a quick comparison of fees for common scenarios:

| Transfer Details | Western Union Fee | MoneyGram Fee |

|---|---|---|

| $200 domestic (bank account, cash pickup) | $0 | $2.99 |

| $500 to Mexico (debit card, cash pickup) | $4.99 | $1.99 |

| $500 to Mexico (credit card, cash pickup) | $11.99 | $20.49 |

| $500 to Mexico (cash at agent, cash pickup) | $8 | $10 |

| $500 to Ireland (debit card, cash pickup) | $5–$7 | $1.99 |

| $500 to Ireland (credit card, cash pickup) | $12.50 | $20.49 |

Key Points to Consider

MoneyGram often provides lower fees for transactions funded with debit cards, especially for international transfers. On the other hand, Western Union can be more economical for credit card payments. Cash transactions at agent locations typically fall in between for both services.

Keep in mind that fees are only part of the equation. Exchange rate margins can significantly affect how much money your recipient ultimately receives, which we’ll dive into next.

Exchange Rates and Hidden Costs

When transferring money internationally, the fees you pay aren’t just about upfront charges. Exchange rate markups can quietly eat into the funds your recipient receives. Both Western Union and MoneyGram apply exchange rates that are less favorable than the mid-market rate - the rate banks use when trading currency. Let’s break down how these hidden costs work and how they affect your transaction.

What Are Exchange Rate Margins?

Exchange rate margins are the difference between the mid-market rate and the rate you’re actually offered. This difference acts as a built-in cost, often overlooked. For instance, MoneyGram’s markups can go as high as 5%. To put this into perspective, if you’re sending $1,000, a 3% markup alone could mean an additional $30 in costs.

Exchange Rate Comparison

Here’s a side-by-side look at the mid-market rates versus the rates offered by Western Union and MoneyGram:

| Currency | Mid-Market Rate | Western Union Rate | MoneyGram Rate |

|---|---|---|---|

| Mexican peso | 1 USD = 22.4119 MXN | 1 USD = 22.1238 MXN | 1 USD = 22.3034 MXN |

| Euro | 1 USD = 0.87658 EUR | 1 USD = 0.8729 EUR | 1 USD = 0.8479 EUR |

| Chinese yuan | 1 USD = 6.99855 CNY | 1 USD = 6.9134 CNY | 1 USD = 6.9547 CNY |

| British pounds | 1 USD = 0.79648 GBP | 1 USD = 0.7888 GBP | 1 USD = 0.7509 GBP |

| Philippine peso | 1 USD = 49.4276 PHP | 1 USD = 48.9355 PHP | 1 USD = 48.2430 PHP |

MoneyGram typically offers better exchange rates compared to Western Union, though Western Union often has lower upfront fees. However, the difference depends on the currency. For example, when converting to British pounds, MoneyGram’s rate of 0.7509 GBP per dollar is significantly lower than both the mid-market rate and Western Union’s rate. On the other hand, for currencies like the Mexican peso and Chinese yuan, MoneyGram’s rates are closer to the mid-market benchmark.

How Much Do Recipients Actually Receive?

The final amount your recipient gets depends on two factors: the transfer fee and the exchange rate margin. Even if a service advertises lower fees, a higher exchange rate markup can reduce the payout. For instance, sending $1,000 to Mexico might result in a total cost (fees plus markup) exceeding $80. In this case, the markup alone could account for more than half of the total transfer cost.

Understanding these hidden costs is essential to ensure you’re making the most of your money transfers.

sbb-itb-165eed9

Total Cost Examples: Actual Transfer Scenarios

When comparing international money transfer services, it’s crucial to consider more than just the upfront fees. Sometimes, a service with a slightly higher fee might actually provide better overall value. Why? Because its exchange rate might be closer to the mid-market rate. Even a small improvement in the exchange rate can significantly increase the amount the recipient receives, making it essential to calculate the total payout rather than focusing solely on fees. This is especially true when factoring in different payment methods.

Take credit card transactions, for example - they often come with much higher fees compared to debit card transfers. With MoneyGram, for instance, credit card fees can be up to six times higher than those for debit cards. This stark difference highlights the importance of considering both the type of fees and the exchange rate markup when evaluating transfer options.

To get the best value, always factor in the full cost - fees, exchange rates, and payment method charges - before making your decision.

Other Factors for U.S. Senders

When deciding between Western Union and MoneyGram, it's not just about fees and exchange rates. Things like transfer speed, payout options, and transaction limits can also play a big role in shaping your overall experience. Knowing these details can help you pick the service that best suits your needs.

Speed and Payout Methods

Both Western Union and MoneyGram are known for their quick transfers, especially for cash pickups, which are often completed in just minutes. This makes them great options when your recipient needs money urgently, whether for an emergency or a time-sensitive expense.

That said, the speed of your transfer can vary depending on how you choose to send and receive the money. For instance, direct-to-bank deposits with Western Union can take up to seven business days, much longer than their cash pickup option. MoneyGram follows a similar pattern - bank deposits generally take more time compared to cash pickups.

If you're looking for faster processing, using a debit card for MoneyGram transfers can speed things up. This payment method tends to process more quickly than other funding options.

When it comes to payout flexibility, both services offer a range of choices, though their strengths differ. Western Union allows for cash pickups, direct bank deposits, and even loading funds onto a Western Union Prepaid Visa card. A standout feature is the ability to change the delivery method mid-transfer, letting you switch from cash pickup to bank deposit or debit card if your plans change.

MoneyGram, on the other hand, provides cash pickups, direct bank deposits, debit card deposits, and mobile wallet transfers in select countries. The debit card deposit option is particularly handy if your recipient wants to avoid visiting an agent location or waiting for bank processing.

Next, let’s take a closer look at how transfer limits and rules vary between these two services.

Transfer Limits and Rules

Understanding transaction limits is key, especially if you're planning to send larger amounts. Western Union and MoneyGram have different approaches here.

For MoneyGram, online transfers are capped at $10,000 per transaction. For international transfers, you can send up to $10,000 over a 30-day period, while domestic transfers allow up to $15,000.

Western Union, however, uses a tiered system. Unverified accounts can send up to $3,000, while verified accounts can transfer up to $50,000. Larger amounts may require additional identity verification and documentation, especially due to compliance regulations.

These limits depend on factors like your transaction history, the destination country, your funding method, and anti-money laundering policies. Larger transfers often undergo extra scrutiny to meet compliance standards.

If you frequently send money or need to transfer substantial amounts, Western Union’s higher limits for verified accounts give you more flexibility. On the other hand, if your needs are simpler - like smaller, regular transfers - MoneyGram's straightforward $10,000 limit might work just fine.

While the verification process might feel like a hassle, it often comes with perks like higher limits and better customer support for managing larger transactions.

Which Provider Costs Less?

When it comes to comparing costs between MoneyGram and Western Union, the answer isn't cut and dried. It all boils down to how you're sending the money and where it's headed.

Main Findings

MoneyGram generally offers lower fees for transfers funded by debit cards. For instance, sending $500 to Mexico costs just $1.99 with MoneyGram, compared to $4.99 with Western Union. Similarly, a $100 domestic bank-to-bank transfer is $1.89 with MoneyGram, while Western Union charges a hefty $13.99. However, the tables turn when using a credit card. In this case, MoneyGram charges $20.49, whereas Western Union's fee is $11.99. For cash-funded transfers, the costs tend to fall somewhere in between these two extremes.

Western Union's pricing, while more complex, can sometimes work in your favor. For example, domestic transfers funded online from a bank account with cash pickup may come with no fee through Western Union. MoneyGram, on the other hand, typically charges a fee regardless of how you fund the transfer. Western Union also has an edge when it comes to sending larger amounts - verified accounts can transfer up to $50,000, compared to MoneyGram's limit of $10,000 every 30 days.

But fees aren't the whole story. Exchange rate margins - essentially hidden costs - play a big role in determining the final payout. Both providers bake these margins into their rates, which means the recipient could end up with less money than expected.

Lastly, geographic reach matters. Western Union's 500,000+ locations worldwide might make it the only viable choice in some remote areas.

What to Do Next

To make the best choice, calculate the total cost of your transfer - fees plus exchange rate margins. Check real-time rates in the Cross Border Payments Companies directory and consider testing small transfers to see which provider consistently meets your needs. This approach ensures you get the best value for your money.

FAQs

How do exchange rate margins impact the cost of international transfers with Western Union and MoneyGram?

Exchange rate margins play a big role in determining the total cost of sending money internationally through services like Western Union or MoneyGram. These margins are essentially a markup added to the mid-market exchange rate, which means the rate you’re given is less favorable than the actual market rate. This difference can quietly increase the overall cost of your transfer.

Here’s an example: even if the upfront transfer fee looks low, the hidden cost buried in the exchange rate can make your transaction pricier than expected. Depending on the provider and the amount being sent, these markups could add anywhere from 5% to 15% to the total cost. This becomes even more noticeable with smaller transfers, where the exchange rate margin takes a bigger chunk out of the final amount your recipient gets.

Being aware of these hidden costs is crucial. It allows you to make smarter choices when deciding between Western Union and MoneyGram for your international money transfers.

What should I consider when deciding between Western Union and MoneyGram for large money transfers?

When you're choosing between Western Union and MoneyGram for large money transfers, a few key considerations can help you make the best decision:

- Transfer limits: Western Union typically allows higher maximum transfer amounts - up to $5,000 for domestic transfers and even higher limits for certain international destinations. This can be a major advantage if you're sending a substantial amount.

- Fees and exchange rates: Western Union's fees can be on the higher side, and they often include a markup on exchange rates, which might increase the overall cost. MoneyGram's fees and exchange rates vary as well, so it's crucial to compare both services based on the specifics of your transaction.

- Destination and payment method: Factors like the destination country and the method of transfer - whether it's a bank transfer, cash pickup, or something else - can impact transfer limits, fees, and processing times. Always double-check these details to ensure the service aligns with your requirements.

By weighing these factors, you can determine which service provides the best fit for your large money transfers.

Do MoneyGram or Western Union charge extra fees when using a credit card for transfers?

Yes, using a credit card for money transfers through services like MoneyGram or Western Union can come with extra costs. Credit card companies often treat these transactions as cash advances, which means you'll likely face fees ranging from 3% to 5% of the transfer amount, plus possible flat fees (usually around $10). These charges are in addition to the transfer fees set by the service provider and might not be immediately clear. To avoid unexpected expenses, it's wise to confirm the details with your credit card issuer before proceeding.