Looking for the best way to send money internationally in 2025? Here's a quick breakdown of the top remittance services, tailored to your needs - whether you're sending money to family, paying freelancers, or running a global business. Each provider offers distinct strengths in fees, transfer speed, and accessibility.

Key Takeaways:

- Western Union: Best for cash pickups with a global agent network but higher fees for convenience.

- MoneyGram: Reliable for quick transfers and retail partnerships, though fees can add up for smaller amounts.

- Ria: Strong option for U.S.-to-Latin America transfers with competitive rates.

- Revolut: Ideal for tech-savvy users with transparent pricing but limited cash options.

- Payoneer: Tailored for businesses and freelancers managing international payments.

- Wise: Transparent pricing with real exchange rates, great for frequent digital transfers.

Quick Comparison:

| Provider | Fee Range | Transfer Speed | Coverage | Best For |

|---|---|---|---|---|

| Western Union | $5-$50+ | Minutes to 5 days | 200+ countries | Cash pickups |

| MoneyGram | $2-$30+ | Minutes to 3 days | 200+ countries | Retail convenience |

| Ria | $3-$25+ | 15 minutes to 2 days | 160+ countries | U.S.-to-Latin America |

| Revolut | $0.50-$15+ | Instant to 2 days | 30+ countries | Digital-first users |

| Payoneer | $2-$50+ | 1-3 days | 190+ countries | Business transactions |

| Wise | $1-$20+ | Seconds to 2 days | 80+ countries | Transparent pricing |

How to Choose:

- Cash pickups? Go with Western Union or MoneyGram.

- Digital transfers? Wise and Revolut excel here.

- Business payments? Payoneer is your go-to.

- Regional focus? Ria specializes in U.S.-to-Latin America routes.

Select a provider based on your specific needs, recipient's access to funds, and how often you send money. Each service has trade-offs, so weigh convenience against cost.

Best International Money Transfer Service 2025💸 [My Honest Recommendation]

1. Western Union

Western Union has been a household name in the remittance world for decades. What started as a telegraph company has transformed into a modern money transfer service, offering both digital solutions and a vast network of physical locations.

Transfer Speed

Western Union gives you flexibility when it comes to transfer speed. Need cash in a hurry? Their cash pickup option can be completed in minutes, though it comes with a higher fee. Bank deposits, on the other hand, take a few business days, while transfers to supported digital wallets are typically quicker. If you're in a rush, expedited cash pickup is available for an extra fee. This range of options ensures you can choose a speed that fits your needs and budget.

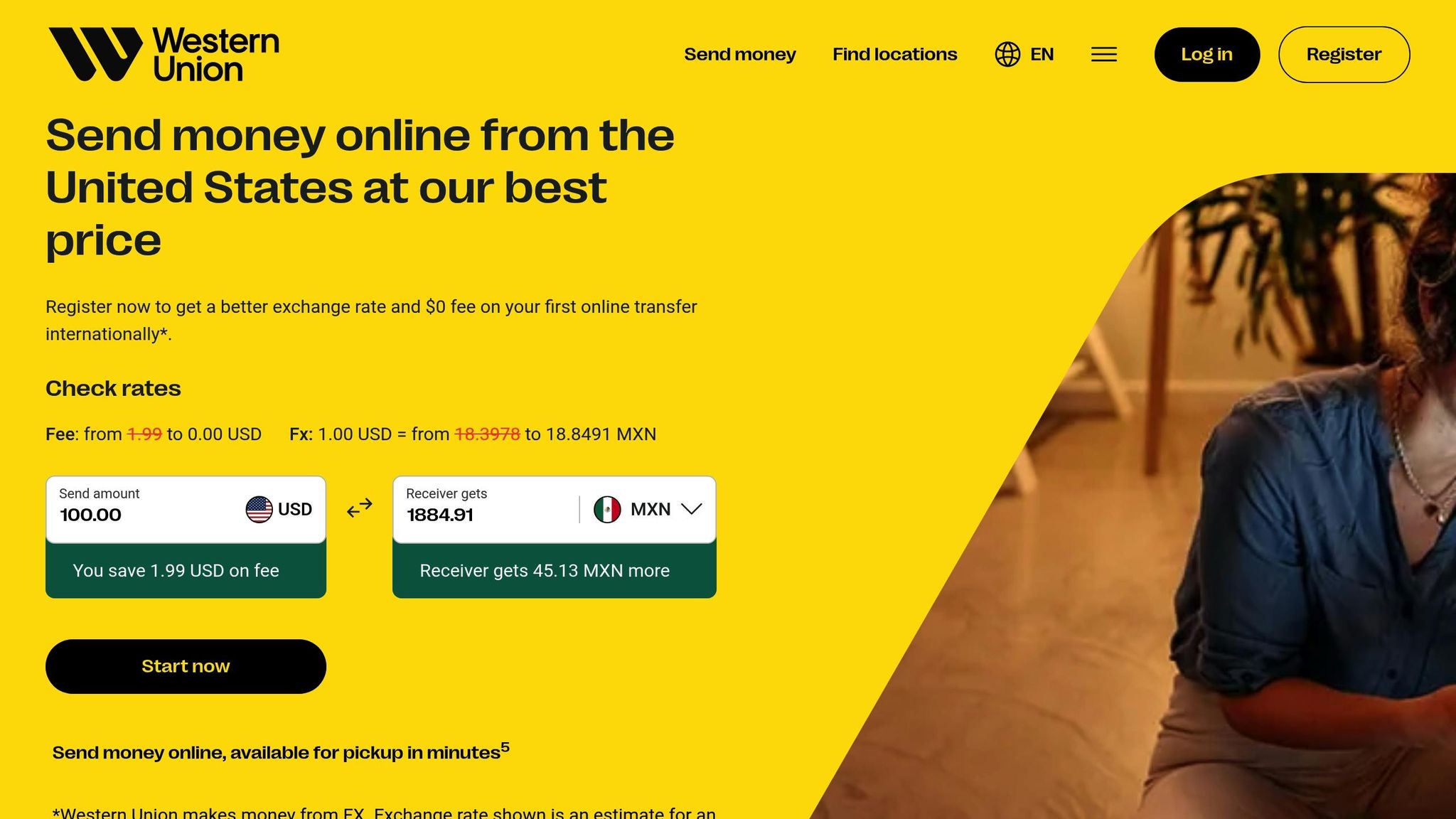

Pricing Structure

Fees with Western Union vary depending on factors like the transfer amount, destination, payment method, and delivery option. Cash-to-cash transfers tend to be the most expensive, while bank-to-bank transfers are usually more affordable. If you initiate a transfer online, you'll often find lower fees compared to visiting a physical location. Keep in mind, the exchange rate margin also changes based on the delivery method you choose.

Global Reach

One of Western Union's standout features is its extensive global network. With agents in numerous countries, it’s a lifeline for regions lacking robust banking infrastructure or for recipients who prefer cash transactions. It’s especially popular in key remittance markets like Mexico, the Philippines, India, and parts of Africa. While their mobile app and online platform enable transfers to many destinations, some recipients may still need to visit a local agent to collect funds. Additionally, Western Union continues to expand its partnerships with digital wallets to increase convenience in various regions.

Security Measures

Western Union takes security seriously, using tools like encryption, identity verification, and fraud monitoring to protect transactions. For cash pickups, recipients need a government-issued ID and a unique Money Transfer Control Number (MTCN) or must answer security questions. Their mobile app even offers biometric verification for added safety.

The company also complies with anti-money laundering regulations and monitors transactions for suspicious activity through its compliance programs. To keep customers informed, Western Union provides tracking tools so you can follow your transfer every step of the way.

With its long history, wide reach, and commitment to secure transactions, Western Union remains a reliable option for anyone looking to send money across borders. Whether you're prioritizing speed, accessibility, or trust, it’s a service that continues to meet the needs of a global audience.

2. MoneyGram

MoneyGram has been a trusted name in international money transfers since its founding in 1940. Over the decades, it has built a reputation for dependable cross-border payments, catering to millions of users through both digital platforms and physical locations.

Transfer Speed

MoneyGram provides a range of delivery options to match different levels of urgency and budget preferences. For instance, cash pickups are typically processed within minutes, while bank deposits generally take 1–3 business days. Transfers to mobile wallets often complete within just a few hours. If you're in a hurry, expedited services are available, though they come with higher fees.

In popular transfer routes - like sending money to Mexico or the Philippines - digital bank transfers initiated before specific cutoff times are often completed the same business day. These flexible speed options are closely tied to the service's pricing structure.

Pricing Structure

MoneyGram's fees depend on several factors, including the transfer speed, destination, payment method, and delivery option. Cash-to-cash transfers tend to have higher fees, whereas online transfers are usually more affordable. Additionally, online transfers often feature more favorable exchange rates than those offered at physical agent locations.

Global Reach

With a presence in over 200 countries and territories and a network of more than 350,000 agent locations, MoneyGram serves even areas with limited banking infrastructure. The service is especially popular in regions like Latin America, Southeast Asia, and Sub-Saharan Africa. Key transfer corridors - such as from the United States to Mexico, the Philippines, and India - benefit from MoneyGram's extensive infrastructure and competitive pricing.

MoneyGram also integrates with digital wallets like GCash in the Philippines, making it easier for recipients to access funds without visiting an agent location. These tailored solutions enhance the service's convenience in high-demand regions.

Security Measures

MoneyGram takes security seriously, employing multiple layers of protection. Transactions are safeguarded with industry-standard encryption, and advanced fraud detection systems monitor for suspicious activity. To collect cash transfers, recipients must provide a government-issued ID and a unique reference number, ensuring a secure process.

For added peace of mind, MoneyGram's mobile app includes features like biometric authentication and transaction tracking. Customers can monitor their transfers in real time and access their transaction history for future reference.

With its blend of speed, global accessibility, and strong security protocols, MoneyGram remains a reliable option for both occasional and frequent money transfers.

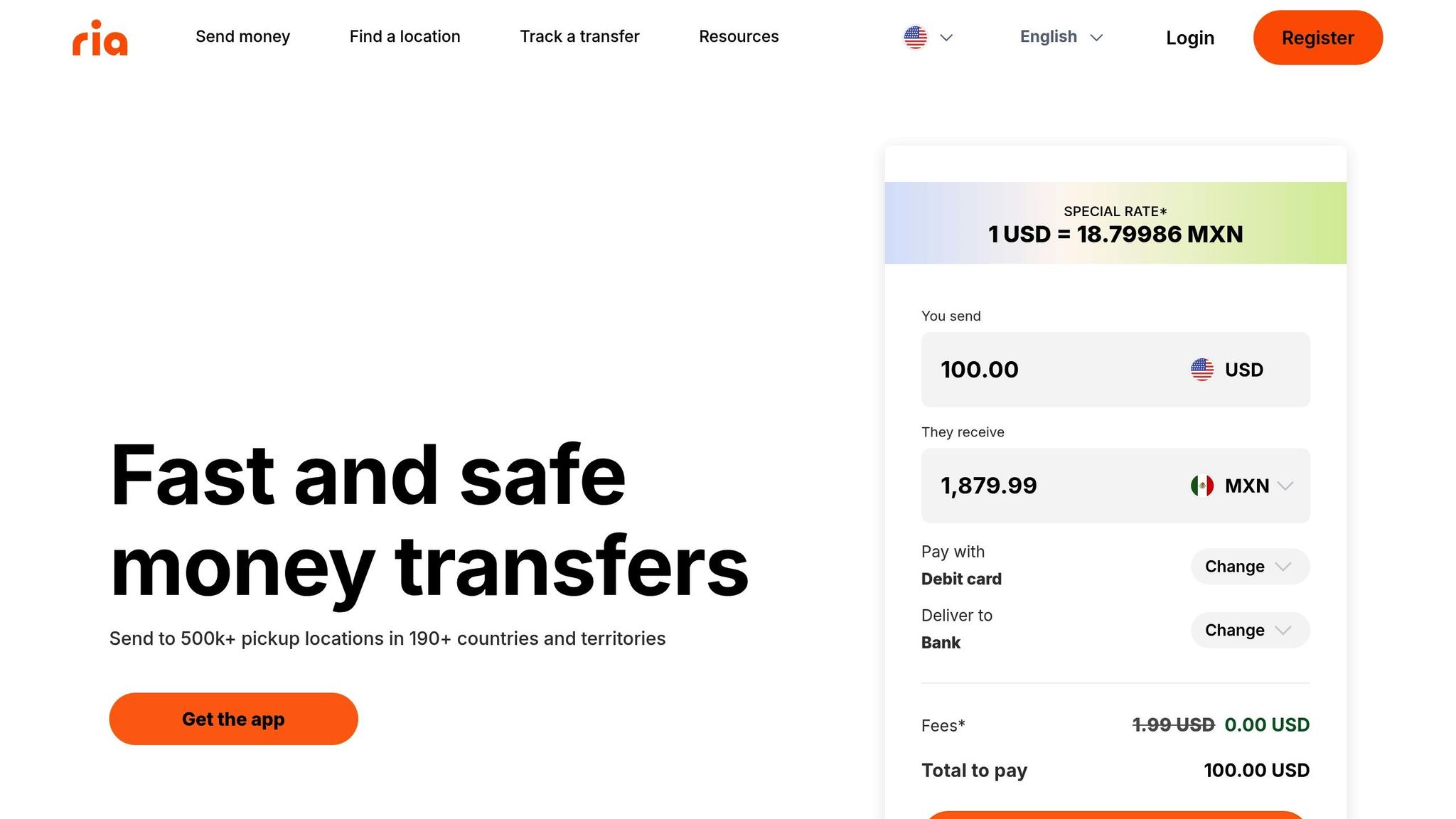

3. Ria

Ria Money Transfer is a long-standing service that offers several ways to send money, including cash pickup, bank deposits, and mobile wallet transfers. The speed and cost of transfers depend on factors like the amount sent, the destination, and the payment method. On top of that, Ria provides competitive exchange rates, making it an appealing option for many users.

The company has established a broad network, enabling money transfers to a wide range of countries and territories. They've also expanded their digital services, allowing recipients in certain areas to access funds through digital wallets - adding more convenience to the process.

When it comes to security, Ria takes it seriously. They use strong safeguards to protect transactions and offer tracking features so both senders and recipients can stay updated throughout the transfer. These efforts reinforce Ria's reputation as a trusted name in the remittance industry.

4. Revolut

Revolut has grown into a versatile financial platform, making international money transfers straightforward and accessible. Operating through a user-friendly mobile app and web platform, it allows users to send money across borders with competitive rates and clear pricing.

Transfer Speed

Revolut ensures consistent transfer speeds, typically processing transfers within 1–2 business days. For users in the European Economic Area, same-day transfers are often possible during business hours. The app also features real-time tracking, so you can follow your transfer's journey from start to finish.

Pricing Model

Revolut’s pricing depends on your account type and the amount you’re transferring. Standard accounts come with a $1,000 monthly limit for fee-free transfers, while Premium and Metal accounts offer higher limits and reduced fees.

The platform uses interbank exchange rates, applying a small markup on weekdays. Transfers made over the weekend may incur up to a 1% markup, which is clearly displayed before you confirm the transaction. This transparency helps users decide the best time to make their transfers.

Unlike traditional services that charge transfer fees, Revolut generates revenue through the exchange rate spread. This often results in lower overall costs compared to providers that combine fees with less competitive rates.

Supported Markets

Revolut supports transfers to over 160 countries and territories, covering major corridors like the United States to Mexico, the United Kingdom to India, and various European routes. It’s particularly strong in European markets, where it holds banking licenses that enable faster processing times.

Popular destinations include the Philippines, India, Mexico, Poland, and Romania. Revolut also supports local banking networks in these regions, ensuring smooth transactions. In recent years, the platform has expanded into Latin America, adding countries like Brazil and Colombia.

The service handles multiple currencies, including USD, EUR, GBP, JPY, and currencies from emerging markets. While recipients can receive funds directly into their bank accounts, Revolut doesn’t currently offer cash pickup or mobile wallet options.

Security Standards

Revolut prioritizes security with features like 256-bit SSL encryption and two-factor authentication. Operating under banking licenses in the UK and EU, the company adheres to strict regulatory standards and capital requirements.

The platform uses machine learning algorithms to detect and respond to suspicious activity in real time. Users can instantly freeze or unfreeze their accounts via the app and review transaction histories for added control.

Customer funds are safeguarded through deposit insurance schemes in applicable regions, and Revolut keeps customer money separate from its operational funds. With regular security audits and compliance certifications, Revolut provides a secure and reliable option for international money transfers.

sbb-itb-165eed9

5. Payoneer

Payoneer is a global payment platform tailored for businesses and freelancers who need to handle international payments. It stands out in the B2B space by offering more than just standard money transfers - it also provides tools for payment collection, currency conversion, and access to working capital.

Transfer Speed

Most international transfers through Payoneer are completed within 1-3 business days. For major markets like the United States, United Kingdom, and European Union, bank transfers usually take 24-48 hours during business days.

One of Payoneer’s strengths is its ability to process incoming payments quickly. When clients or marketplaces send money to a Payoneer receiving account, the funds typically show up in the recipient's Payoneer balance almost instantly. From there, users can either withdraw the money to their local bank accounts or keep it in their Payoneer account for future use.

While Payoneer doesn’t offer express transfer options, it’s particularly efficient at handling batch payments for businesses managing multiple transactions at once.

Pricing Model

Payoneer’s fees are structured with businesses in mind, and costs vary depending on the type and volume of transactions. For standard bank withdrawals to local accounts, the platform charges a flat fee of $1.50.

Currency conversion fees range between 0.5% and 2% above the mid-market exchange rate. Common currencies like USD, EUR, and GBP tend to have lower conversion fees, while transactions involving less commonly traded currencies may cost more.

For receiving payments, Payoneer charges between 0.25% and 3% of the transaction amount. High-volume users benefit from lower fees, and businesses processing over $100,000 annually can qualify for discounts, making it a cost-effective option for larger enterprises.

Additional revenue is generated through services like Payoneer Capital, which offers working capital solutions, and foreign exchange spreads. Unlike platforms aimed at casual users, Payoneer is designed for businesses that maintain balances and conduct frequent international transactions, offering cost efficiencies that appeal to global companies.

Supported Markets

Payoneer operates in over 150 countries and supports more than 70 currencies, making it a versatile option for businesses in regions with limited access to traditional banking. It has a strong presence in emerging markets across Latin America, Eastern Europe, Asia, and Africa.

The platform has established partnerships with local banks in key markets such as India, the Philippines, Pakistan, and Mexico, allowing for faster transfers and reduced fees in these areas.

With its Global Payment Service, users can receive payments as though they have local bank accounts in countries like the United States, United Kingdom, European Union, Japan, and Australia. This feature is especially useful for freelancers and businesses working with clients who prefer domestic payment options.

Payoneer supports various payout methods, including direct bank transfers, Payoneer’s prepaid Mastercard, and integrations with platforms like Amazon, Airbnb, and Upwork. However, it does not provide cash pickup locations or mobile money services, focusing instead on digital banking solutions.

Security Standards

Payoneer prioritizes security with features like 256-bit SSL encryption and multi-factor authentication for account access. It holds money transmitter licenses in relevant regions and complies with international anti-money laundering regulations.

The platform uses real-time fraud monitoring powered by machine learning to identify suspicious transactions. Business accounts also benefit from advanced security options, such as role-based access controls, which allow companies to assign specific permissions to team members.

Customer funds are kept separate from Payoneer’s operational funds and are stored with tier-one banks worldwide to ensure safety. Additionally, the platform provides detailed transaction reports and audit trails, which are essential for businesses managing compliance with international payment regulations.

Payoneer undergoes regular security audits and adheres to PCI DSS standards, ensuring the protection of sensitive financial data. Dedicated customer support is available for security concerns, with specialized teams ready to assist business users with account access issues or suspicious activity.

6. Wise (formerly TransferWise)

Wise has built a reputation for offering transparent pricing and real exchange rates. With support for transfers in over 40 currencies, users can see exactly what they'll pay before sending money internationally.

Security Standards

Wise has established a strong global presence while maintaining a focus on security. Regulated by local financial authorities and holding over 65 licenses, the platform conducts an impressive 7 million security checks daily - that's about 80 checks every second - to safeguard against fraud.

"Our promise is to protect every cent, dollar and peso with cutting-edge tech and anytime customer support."

To ensure customer funds are secure, Wise keeps them completely separate from its own operational money. These funds are stored in cash or other secure liquid assets, rather than being loaned out like traditional banks. As of September 30, 2024, Wise held the equivalent of 14.7 billion GBP in customer accounts. The company employs over 1,000 anti-fraud specialists and uses advanced tools like machine learning, supported by Amazon SageMaker Studio, to enhance fraud prevention and Know Your Customer (KYC) processes. Automated monitoring and strict data governance further reinforce these efforts.

Wise's public API is built with secure REST protocols and OAuth authentication. The company has also adopted the SLSA framework for its build processes and uses a microservice architecture with pre-configured security defaults. This setup allows teams to concentrate on core business tasks while maintaining high security standards.

Advantages and Drawbacks

Every money transfer provider comes with its own strengths and weaknesses. Knowing these trade-offs can help you choose the right service based on your specific needs and priorities.

Western Union is unmatched in global reach, thanks to its extensive network of physical locations. It's a go-to option for cash pickups. However, this convenience comes with higher fees compared to digital-focused alternatives.

MoneyGram often offers competitive pricing for certain transfer routes and has strong partnerships with retail outlets, making it reliable for cash pickups worldwide. That said, fees can climb quickly for smaller transfers. While digital transfers are typically faster and more cost-effective, the platform's interface feels outdated compared to newer competitors.

Ria specializes in specific regional corridors, especially between the US and Latin America, where it often provides better rates and faster service. It supports various payout options like cash pickups and bank deposits. However, its coverage outside these core regions is more limited, and customer service can be hit-or-miss.

Revolut caters to tech-savvy users with its sleek app and competitive exchange rates for premium account holders. It integrates well with other banking services and offers instant transfers within its network. The downside? Limited cash pickup options and higher fees for standard account users, which makes it less appealing for cash-based transactions.

Payoneer shines in business-to-business transfers and payments for freelancers, offering robust multi-currency account features. It’s great for larger transfers and integrates seamlessly with e-commerce platforms. However, it’s not as user-friendly for personal remittances and often requires recipients to have some technical know-how.

Wise is known for its transparent pricing, offering real exchange rates without hidden markups. It’s a cost-effective option for most transfer amounts and supports over 40 currencies. However, it lacks widespread cash pickup locations, which may not suit recipients who prefer physical access to funds.

Here’s a quick comparison of key factors like fees, speed, and global coverage to help you evaluate these providers:

| Provider | Average Fee Range | Transfer Speed | Global Coverage | Best For |

|---|---|---|---|---|

| Western Union | $5-50+ | 1-5 business days | 200+ countries | Cash pickup needs |

| MoneyGram | $2-30+ | 10 minutes-3 days | 200+ countries | Retail convenience |

| Ria | $3-25+ | 15 minutes-2 days | 160+ countries | Latin America corridor |

| Revolut | $0.50-15+ | Instant-2 days | 30+ countries | Digital-first users |

| Payoneer | $2-50+ | 1-3 business days | 190+ countries | Business transfers |

| Wise | $1-20+ | 20 seconds-2 days | 80+ countries | Transparent pricing |

This table highlights the key trade-offs between convenience and cost. Providers like Western Union and MoneyGram charge higher fees for their extensive physical networks and instant cash services. On the other hand, digital-first platforms such as Wise and Revolut offer better rates but expect recipients to have bank accounts or digital payment capabilities.

How often you send money also plays a role. If you’re transferring funds regularly, premium accounts from providers like Revolut or Payoneer may save you money in the long run with reduced per-transaction fees. For occasional senders, traditional providers with pay-per-use models might be more practical.

Regulatory requirements vary between providers. Established names often have stricter documentation processes and tighter limits, while newer fintech platforms streamline onboarding but may lack flexibility for complex scenarios.

The recipient’s experience is another important factor. Cash pickup services allow immediate access to funds, which is crucial in areas with limited banking infrastructure. Digital transfers, while offering better rates and tracking features, assume recipients have access to financial accounts and are comfortable with technology.

Final Recommendations

Selecting the best remittance service depends on several factors: your specific needs, how often you send money, and how your recipient can access the funds. If cash pickups are your priority, Western Union stands out with its extensive agent network, while MoneyGram offers competitive pricing for similar services.

For those who prefer digital solutions, Wise is a top pick. It’s known for transparent pricing and using real exchange rates, which makes it especially appealing for frequent transfers.

If you're a business owner or freelancer looking for cost-effective solutions, Payoneer might be your go-to. Its multi-currency accounts and seamless integration with e-commerce platforms make it ideal for managing high-volume transactions, though its setup may require a bit more technical know-how.

For regional transfers, particularly in Latin America, Ria delivers reliable performance in terms of both speed and cost. It’s a strong option for those sending money regularly within specific corridors.

Tech-savvy users might appreciate Revolut, especially if they hold premium accounts. With instant transfers and competitive rates, it’s a good fit for those whose recipients can easily access digital payments.

When choosing a provider, consider your recipient's access to financial services, how often you’ll send money, and the compliance requirements of your transfer corridor. In some cases, paying slightly higher fees may be worth it for secure and efficient delivery.

Keep in mind that the remittance landscape is constantly changing. As your needs evolve and your recipient's access to financial services improves, it’s worth revisiting your options to ensure the best fit.

FAQs

What should I consider when choosing the best remittance service for my needs?

When choosing a remittance service, there are a few important things to keep in mind to make sure it fits your needs. Start by looking at the total cost, which includes not just the fees but also the exchange rates. These two factors combined will give you a clear picture of how much you're actually spending. Another key consideration is the transfer speed - this can be crucial if you're in a hurry to get the money to its destination.

You’ll also want to prioritize security and reliability to ensure your funds are safe and arrive without any complications. Additionally, think about the purpose of your transfer. Are you sending money for personal reasons or for business? Some services are better suited for one over the other, so it’s worth checking.

Taking the time to evaluate these factors will help you pick a service that matches your priorities and makes the process smooth and hassle-free.

What should I look for when comparing fees and transfer speeds of remittance services?

When evaluating remittance services, it's crucial to look at two key factors: total cost and transfer speed.

Total cost isn't just about the upfront fees; it also includes less obvious charges like exchange rate markups. These hidden costs can add up, so it's essential to calculate the full amount you'll spend to send money. Different providers often have vastly different fee structures, so doing your homework can save you a lot.

Transfer speed is another major consideration. Some services can deliver funds almost instantly, while others may take a few days. Finding the right balance between cost and speed is important, whether you're sending money to help a loved one or managing business transactions. Matching the service to your priorities ensures a smoother experience.

What security measures are in place to protect my money when using remittance services?

When using remittance services in the U.S., your money and personal information are protected by strong security measures. These services rely on encryption technology to keep your data secure, two-factor authentication (2FA) to control account access, and strict adherence to anti-money laundering (AML) and counter-terrorism financing (CFT) regulations.

Key protections include verifying customer identities, keeping an eye on transactions for unusual activity, and following established industry standards. All of these efforts work together to ensure your funds and transactions are well-protected.